Just as single-income families began to vanish in the last century, many of America’s elderly are now forgoing retirement for the same reason: They don’t have enough money. Rickety social safety nets, inadequate retirement savings plans and sky high health-care costs are all conspiring to make the concept of leaving the workforce something to be more feared than desired.

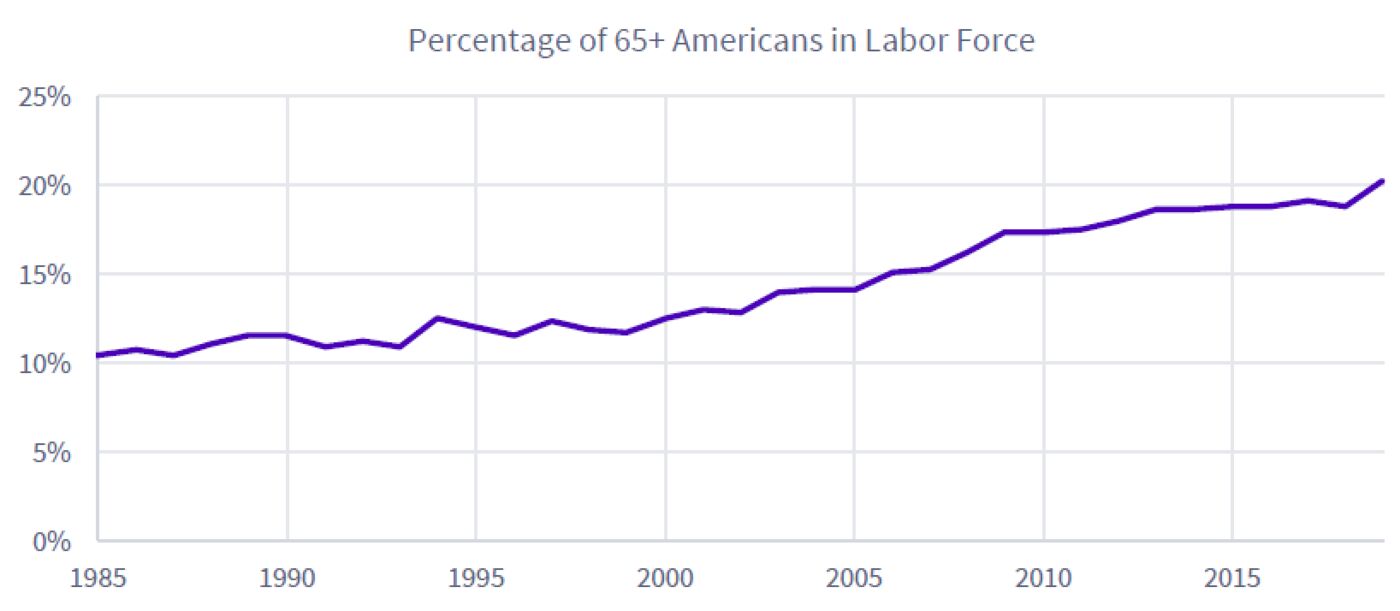

For the first time in 57 years, the participation rate in the labor force of retirement-age workers has cracked the 20 percent mark, according to a new report from money manager United Income (PDF).

As of February, the ranks of people age 65 or older who are working or seeking paid work doubled from a low of 10 percent back in early 1985. The biggest spike in employment has gone to college-educated older workers; the share of all employees age 65 or older with at least an undergraduate degree is now 53 percent, up from 25 percent in 1985.

This rise of college-educated older workers has pushed the demographic’s inflation-adjusted income up to an average of $78,000, 63 percent higher than the $48,000 older folks brought home in 1985. By comparison, American workers below the age of 65 saw their average income rise by only 38 percent over the same period, to an average of $55,000. United Income’s calculations draw on recently released data from the Census Bureau and the Bureau of Labor Statistics (BLS).

There’s a mismatch between older workers who need the income the most and those who are able to work and working, said Elizabeth Kelly, senior vice president of operations for United Income and a former special assistant to the president at the White House National Economic Council during the Obama administration.

“These are the more educated, wealthier individuals in better health who are continuing to work, but it’s probably…

This article was sourced from Bloomberg.